What has been financed with sukuk ?

The Palm

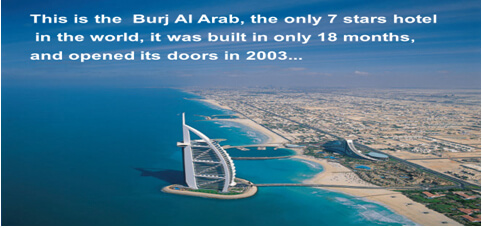

Burj Al Arab

Workshop Presenter : Brian Kettell

Brian most recently worked as an Advisor to the CEO for a branch of the Islamic Development Bank in Jeddah, Saudi Arabia. His work involved him making presentations to the IDB Sharia’a Board and working with the IDB Sukuk team. He has taught courses on sukuk at a range of financial institutions including the African Development Bank, National Commercial Bank (Saudi Arabia), Global Investment House (Kuwait), Noor Islamic Bank (UAE), the UK Treasury, the Central Bank of Iran, the Central Bank of Syria, the Securities Investment Institute, the Institute for Financial Services and Scotland Yard. He has published widely on sukuk.

Why do you need a workshop in Sukuk?

Since being brought to market 30 years ago, Sukuk have enjoyed continued growth within the Islamic finance industry and have proved resilient to the impact of COVID-19. The first Sukuk was brought to market in 1990. Today, total issuance surpasses $1.35 trillion, and over 15,000 have been issued by a variety of corporate, sovereign and quasi-sovereign bodies across 31 countries.

Around 90 percent were issued in the past 10 years, and 55 percent in the past five. Their growth and development was further accelerated when several non-Muslim countries issued their debut Sukuk, including Hong Kong, Luxembourg, South Africa, Senegal, and the United Kingdom.

Sukuk is an Arabic word that means ‘certificates’. In finance, it stands for bonds that are structured in a Sharia’a-compliant manner. In other words, they are a form of bonds that are accepted by Islamic finance investors and issuers. They come in various structures such as Ijara, Murabaha, Mudaraba, and several other forms. Sukuk issuers ensure that the raised funds are invested in areas that do not contradict Islamic laws.

Sukuk Training Solutions?

Sukuk are seen as well-suited for infrastructure financing because of their risk-sharing properties and could also help fill other financing gaps. The supply of Sukuk, however, falls well short of demand. This is largely due to the lack of expertise in sukuk structuring.

OBJECTIVES & LEARNING OUTCOMES

The workshop provides a comprehensive theoretical and practical knowledge of the principles and operations of sukuk and Islamic finance. On successful completion of the workshop learners will have the ability to structure sukuk issues, to manage Islamic banking operations, develop innovative products and provide solutions to the challenges faced by financial institutions. It also provides a good foundation on which the participants can benefit from developing their skills in their current positions in the Islamic banking and financial sector.

THREE STAGES

Training Preparation: Initial interview, pre-test with results to be used as input to the training design learning roadmap per trainee, define learning style and the gap needed to be bridged.

Deliverables: usage of training cycle approach with logistics requirements such as: Training Schedule and Metrics, PowerPoint, Excel worksheets and Case Studies. Performance support plan, training needs support materials, review process, checkpoints, learners’ assessment and session evaluation.

Functional Deliverables: practical exercise activities such as: role play, brainstorming, dialogue, peer discussion. Case studies & questionnaire and finally, post-test to measure knowledge and skill. This may include access to Computer Based Training.

Who should attend?

The course package is aimed at all those who would like to acquire a solid foundation in sukuk and Islamic banking & finance. It may also be useful to those who simply need a “refresher” of their existing skills.

Workshop Package Content

Module 1 (10 sessions)

A Refresher on the principles of Islamic finance

Module 2 (10 sessions)

The Sharia’a contracts which underpin Sukuk structures

Module 3 (10 sessions)

Securitization and financial engineering

Module 4 (15 sessions)

Sukuk structuring principles

LECTURE SCHEDULE

Module 1: Islamic Banking and Finance Refresher

(10 sessions)

| Session | Session Contents | Method | Assessments |

|---|---|---|---|

| 1 | Basic Islamic finance principles- key role of counter-values | PPT | 2 hours |

| 2 | Introduction to Sharia’a law Role of the Madhabs- what you need to know to analyses the sukuk market | Writing Exercise | 2 |

| 3 | Islamic prohibitions affecting sukuk issuance (including riba, gharar and maysir) | PPT Brainstorming | 2 |

| 4 | Conventional and Islamic financial intermediation | Peer discussion | 2 |

| 5 | Role of Sharia’a boards and the masjid principle | PPT | 2 |

| 6 | Islamic capital markets – a review | Role Playing | 2 |

| 7 | Legal infrastructure for Islamic finance | Exercise | 2 |

| 8 | Sharia’a compliant wholesale markets | PPT | 2 |

| 9 | Islamic derivatives and hedge funds | PPT | 2 |

| 10 | Assessment and feedback. Q & A. | Open dialogue | 2 |

Module 2: The Sharia’a nominate contracts needed for Sukuk market analysis

(10 sessions)

| Session | Session Contents | Method | Assessments |

|---|---|---|---|

| 1 | Sharia Law principles and the Madhabs : the role of counter- values within Islamic finance | PPT | 2 hours |

| 2 | Murabaha contract | Writing Exercise | 2 |

| 3 | Mudaraba contract: Tier 1 and Tier 2 | Brainstorming | 2 |

| 4 | Musharaka contract | Peer discussion | 2 |

| 5 | Ijara and the Ijara Wa- Iktina contracts | PPT | 2 |

| 6 | Istisna’a contract | Role Playing | 2 |

| 7 | Salam contract | Exercise | 2 |

| 8 | Comparative survey of the Sharia’a contracts | PPT | 2 |

| 9 | Malaysian contracts : Bai Al Inah , Bai Al Dayn | PPT | 2 |

| 10 | Assessment and feedback. Q & A. | Open dialogue | 2 |

Module 3: Securitization principles: The basis for Sukuk market structuring

(10 sessions)

| Session | Session Contents | Method | Assessments |

|---|---|---|---|

| 1 | Islamic investment principles | PPT | 2 hours |

| 2 | Introduction to securitization: terminology | Writing Exercise | 2 |

| 3 | Bankruptcy remote vehicles, SPVs, subordination and tranching | PPT Brainstorming | 2 |

| 4 | Credit Enhancement options | Peer discussion | 2 |

| 5 | Role of the Rating agencies | PPT | 2 |

| 6 | Conventional market securitisation | Role Playing | 2 |

| 7 | Islamic market securitisation | Exercise | 2 |

| 8 | Sukuk Market principles | PPT | 2 |

| 9 | Risk factors | PPT | 2 |

| 10 | Assessment and feedback. Q & A | Open dialogue | 2 |

Module 4: Sukuk Market Fundamentals

(15 sessions)

| Session | Session Contents | Method | Assessments |

|---|---|---|---|

| 1 | Introduction to sukuk : Terminology and classification | PPT | 2 hours |

| 2 | Comparison of sukuk with bonds | Writing Exercise | 2 |

| 3 | Asset backed versus asset based sukuk | PPT | 2 |

| 4 | Role of SPVs , Purchase Undertakings and Origination | Peer discussion | 2 |

| 5 | Sukuk risks and the rating agencies | PPT | 2 |

| 6 | Sukuk structures applying the Ijara and Ijara Wa Iktina co | Role Playing | 2 |

| 7 | Sukuk structures applying the Mudaraba contract | Exercise | 2 |

| 8 | Sukuk structures applying the Musharaka contract | PPT | 2 |

| 9 | Sukuk structures applying the Murabaha contract | PPT | 2 |

| 10 | Sukuk structures applying the Salam contract | Discussion | 2 |

| 11 | Sukuk structures applying the Istisna’a contract | Brainstorming | 2 |

| 12 | Malaysian Sukuk | Examples | 2 |

| 13 | Green Sukuk | Brainstorming | 2 |

| 14 | Istithmar Sukuk | Open dialogue | 2 |

| 15 | Assessment and feedback. Q & A | Written Test | 2 |

WORKSHOP ASSESSMENT

EVALUATION CRITERIA