About the Author: Brian Kettell

The team worked, until recently, as an Advisor to the CEO at the Islamic

Development Bank Group based in Jeddah, Saudi Arabia. They worked for several years as a Senior Economist for the Central Bank of Bahrain and the Arab Banking Corporation

We have worked with the Sukuk structuring team for several central banks and

for the IDB. They taught Sukuk courses at numerous GCC Banks and throughout Africa with the African Development Bank.

They have given presentations at Harvard Business School.

We have published 11 books on Islamic Finance.

Why study this course ?

The emphasis of these training materials is to illustrate how the Sharia’a nominate contracts are applied in practice. Most courses simply teach you the products with little practical application The course covers advanced topics in Islamic banking and finance. The topics include Islamic structured finance, Islamic financial engineering, Islamic risk management, Islamic credit cards, Takaful, Islamic profit rate swaps etc Emphasis is placed on several issues :- What does the finance literature tell us about conventional debt finance?

- What does the finance literature tell us about pure Sharia’a finance models?

- Agency problems, asymmetric risk and moral hazard issues

- Agency theory solutions as put forward for conventional banks and for Islamic banks

- Problems associated with PLS in practice

COURSE LEARNING OUTCOMES:

Upon the completion of these training module you should be able to: -- Apply conventional finance principles to issues raised within Islamic finance

- Evaluate the practical implications of applying the Sharia’a nominate contracts

- Distinguish between Takaful, Re-Takaful, and traditional insurance contracts

- Apply techniques from financial engineering to construct Sharia’a - compliant products, such as profit rate swaps and FX derivatives

- Demonstrate how Islamic credit cards differ from conventional credit cards

AIF 1. The applicability of the key Sharia’a Contracts

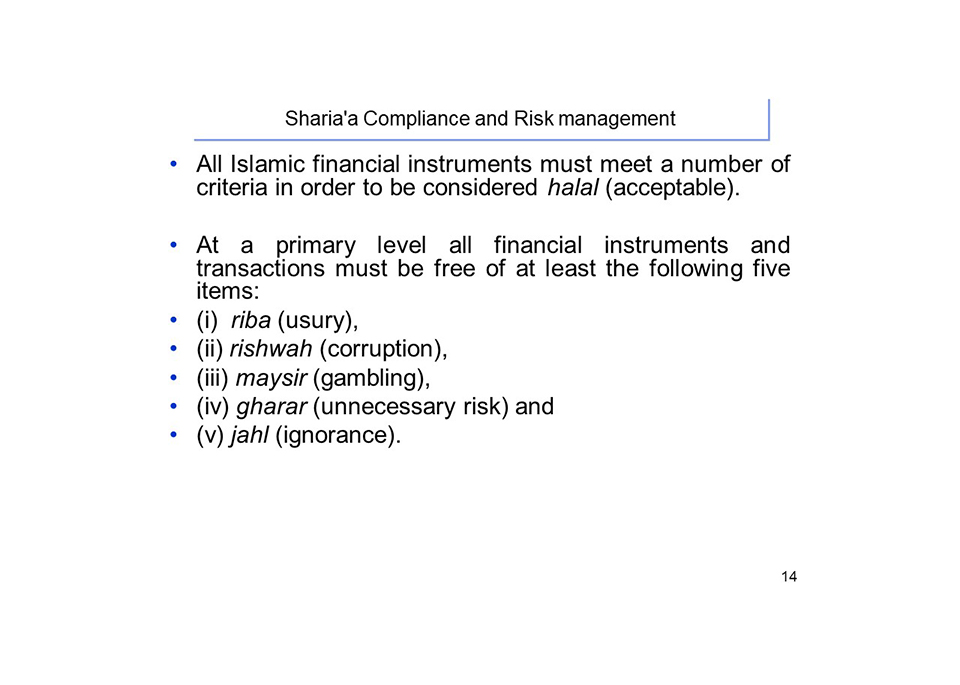

- Review the common Sharia’a principles underlying all Islamic financial instruments?

- Nature of Islamic contracts

- Countervalues and the nominate contracts

- The Madhabs and their impact on the evolution of Islamic finance

AIF 2. Intermediation and transactional contracts

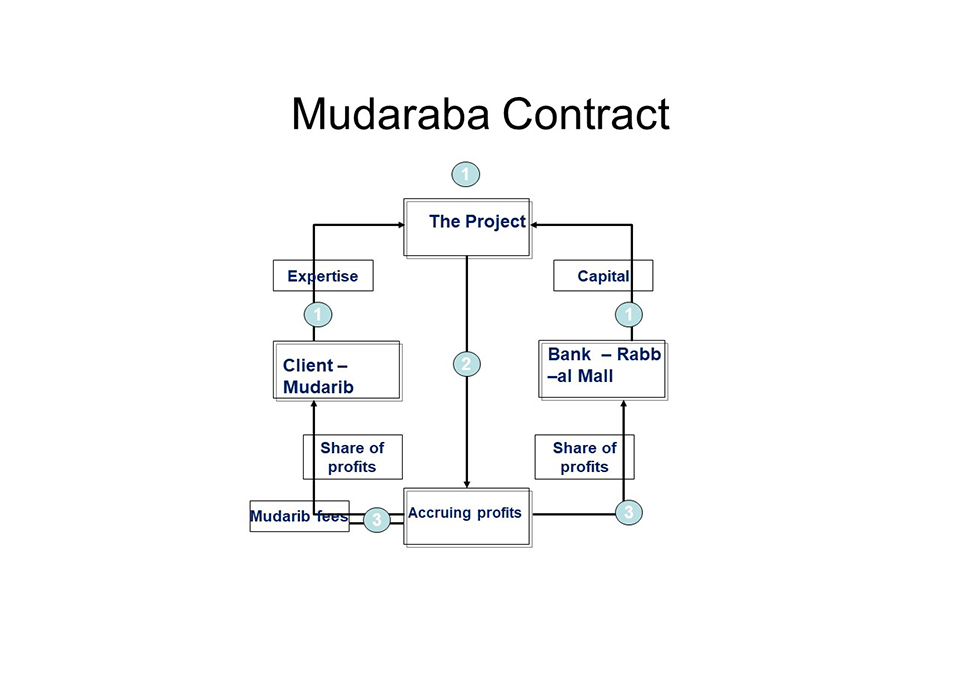

- Restricted and Unrestricted Mudaraba, Kafala, Amana, Takaful, Wakala, Ju’ala

- Transactional contracts: Murabaha, Salam, Ijara, Ijara Wa-Iktina , Istisna’a, and Parallel Istisna’a

- Musharaka varieties, Diminishing Mutanisia ,Two-tier Mudaraba and their applications

- Secured commodity Murabaha : impact of contango and backwardation

- The critical limitations of each of these contracts

AIF 3. Takaful (Islamic Insurance)

- What can we learn from the Qur’an and Sunnah?

- Diyya , the hadith and the role of insurance within Islam

- Description of Takaful systems

- Role of Tabarru and charitable donations within Islam

- Major differences between Takaful and conventional Insurance

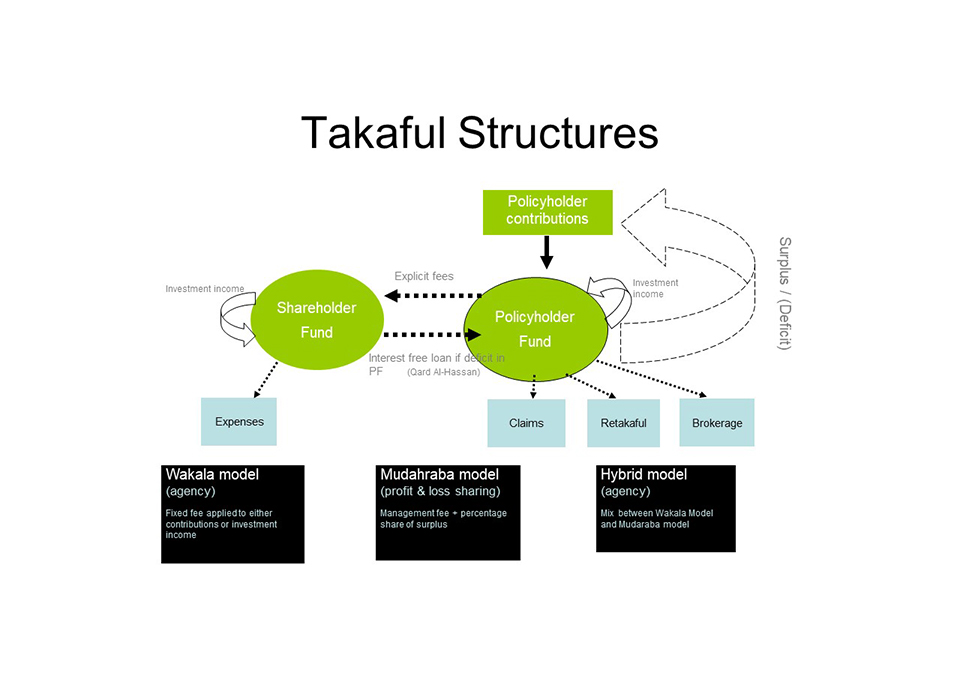

AIF 4. Takaful models

- Takaful Models, Mudaraba, Wakala, Unrestricted Wakala and hybrid systems

- Family and General Takaful

- Re-Takaful and its applications

- Accounting and Technical provisions

AIF 5. Islamic Structured Finance and Islamic Finance engineering

- Islamic securitization and how it differs from conventional securitization

- Terminology: Obligor, Obligator, Issuer, credit enhancer etc

- Pass through and pay through vehicles

- Role of SPVs and bankruptcy remote vehicles

- Islamic credit default swaps

- Risks with these operations

AIF 6. Role of the Special Purpose Vehicle with Sukuk structures

- Role of SPV’s, with Mudaraba contracts

- Role of SPV’s, with Musharaka contracts

- Role of SPV’s with Ijara contracts

- Role of SPV’s with Istisna’a contracts

- Role of SPV’s with Salam contracts

- Role of SPV’s with Murabaha contracts

AIF 7. Risk in Islamic finance

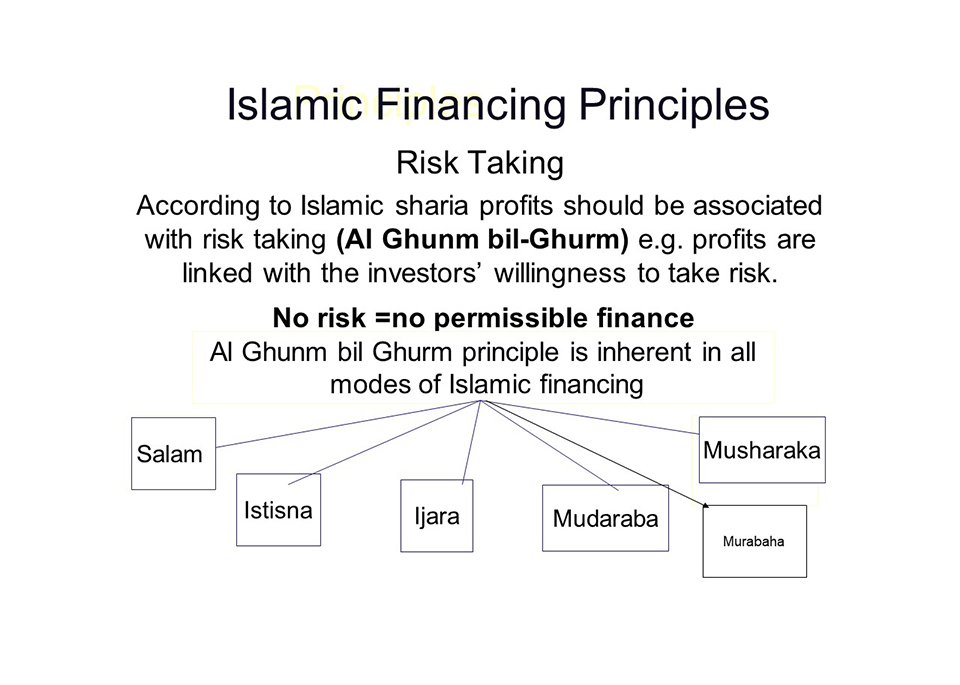

- Islamic concept of risk

- Sharia’a issues with hedging , leverage, and short selling

- Sharia’a issues of existence, ownership, possession, and delivery (qabdh)

- Profit rate swaps-structuring issues

- Wa’ad and Arboun contracts

- Synthetic Currency Forwards

- The Framework of Al-Khiyar

AIF 8. Islamic Credit Cards

- Debit and Charge Cards within Sharia’a principles

- Credit Card Structures

- Repurchase (Bai-al-Inah) credit card models

- Bill Discounting (Bai-al-Dayn) credit card models

- AAOIFI Sharia'a Standards on Debit, Credit and Charge Cards

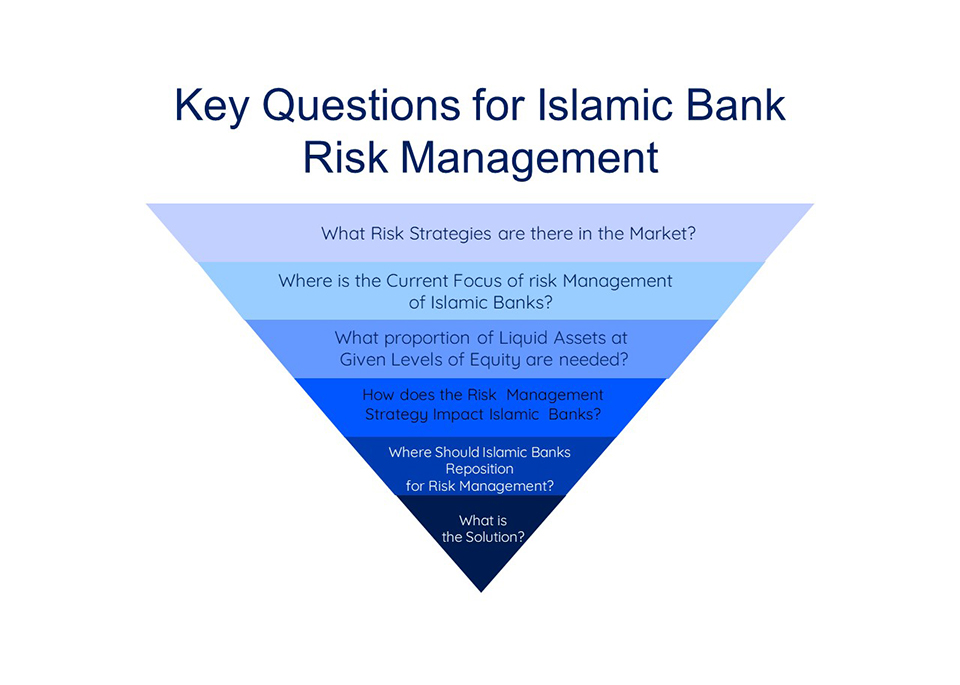

AIF 9. Assessing Risk in Islamic Banking

- What are the risks faced by Islamic banks which are not faced by conventional banks?

- Islamic hedging tools

- Business risks: displaced commercial risk, withdrawal risk, solvency risk

- Governance risks: fiduciary risk, operational risk, transparency risk

- Transactions risks: credit risk, market risk, mark up risk

- Treasury risks: asset and liability management, liquidity risk, hedging risk

- Systemic risks: regulatory risk, business environment risk, institutional risk

- CAMEL ratings

- Investment Reserve Requirements

- Profit Equalisation Reserves

AIF 2 - Sharia Models

£20.00

AIF 3 - Takaful basics

£20.00

AIF 4 - Takaful Models

£20.00

AIF 8 - Islamic Credit cards

£20.00